Hat Tip: BIS

As Fed moves closer to raise interest rates, the dollar denominated debt is coming back to haunt emerging economies as both absolute levels of debt and interest rates on the debt will rise.

Thursday, March 26, 2015

Wednesday, March 25, 2015

Sunday, March 22, 2015

Thursday, March 12, 2015

Tuesday, March 10, 2015

Monday, March 2, 2015

Friday, December 26, 2014

Friday, December 19, 2014

Opec States Scramble to Avoid Debt Default

To cut production to maintain oil prices required to balance budgets OR wait till the lower oil prices takes out marginally expensive shale production (in some fields), OPEC is on a slippery slope here.

Hat Tip: The Big Picture

Hat Tip: The Big Picture

|

| Click to enlarge |

Monday, September 22, 2014

Sunday, August 24, 2014

Weekly Market Commentary - Aug 18, 2014 - Aug 22, 2014

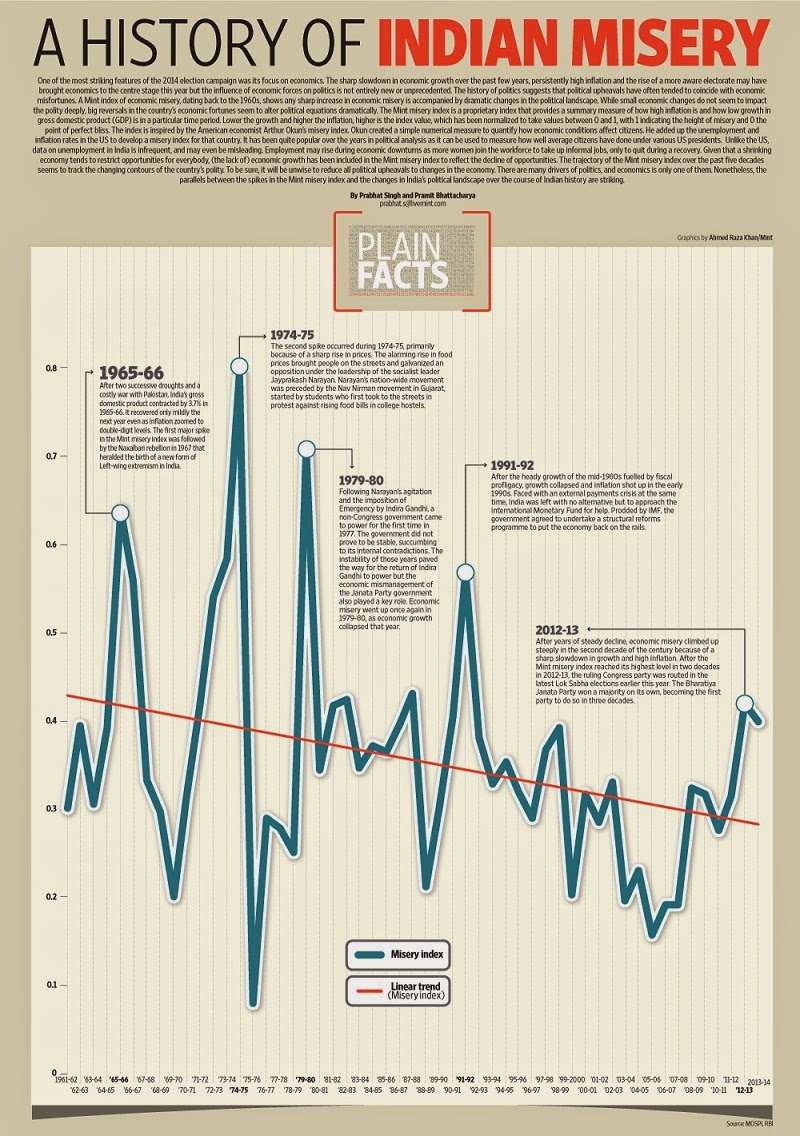

PM Narendra Modi’s maiden Independence Day speech did well to excite Indian citizens with prospects of wonderful days ahead and enthuse investors to pour money into the Indian markets.

One thing is for sure, India is no longer business as usual. Things are changing, albeit at a slower pace than some expected, but it is changing. More and more projects are been given green light – without losing the focus on environmental issues, societal changes have been signaled without ruffling the opposition’s feathers and efforts are been made to drastically cut down the red tape and make India one of the world’s favored business destination (WB ranks us at 134 out of 189 economies ranked).

Modi also send the last reminiscent of India’s attempt of mimicking Soviet’s command economy – Planning Commission packing. With Planning Commission gone, the focus turns back to decentralization of Indian economy with states getting even more financing powers and autonomy going forward.

Sensex ended this week up by 1.2% while Nifty was up by 1.6% and Midcap up by 3.6%

Monday - Sensex up by 1.1%, Nifty up by 1.1%, Midcap up by 1.7%

Investors cheered as PM Narendra Modi delivered his maiden Independence Day speech where he vowed to make radical changes in the way country is run especially the bureaucratic setup. The news of declining WPI to five- month low and easing of tensions over Ukraine also boosted the positive sentiment.

Tuesday - Sensex up by 0.1%, Nifty up by 0.3%, Midcap up by 1.0%

Both Sensex and Nifty continued their journey upwards as oil retailers surged after Brent hit its 14-month low. FII sentiment is buoyed by positive noises made by Modi govt. on reforms and strong trust on RBI governor Raghuram Rajan’s ability to tackle exchange rate crises and inflation. Falling crude prices have also added to the bullish sentiment as India’s import burden eased.

Wednesday - Sensex down by 0.4%, Nifty down by 0.3%, Midcap up by 0.3%

Benchmark indices corrected after rallying continuously for six days as investors booked profits ahead of scheduled US Fed meeting on Thursday.

Thursday - Sensex up by 0.2%, Nifty up by 0.2%, Midcap up by 0.4%

Both Sensex and Nifty edged higher as FIIs continued to pour money in Indian markets, especially in blue-chips reflecting continued optimism about corporate earnings and a recovery in the domestic economy. Slipping in crude oil prices as China reported slowdown in its huge factory sector also helped the sentiment.

Friday - Sensex up by 0.2%, Nifty up by 0.3%, Midcap up by 0.2%

Nifty closed at its all-time high of 7,913.20 points led by IT stocks - which rallied on the news of improving prospects of US economy, and banks rose as RBI looks into reviewing lending caps to align them with global standards set by Basel committee.

One thing is for sure, India is no longer business as usual. Things are changing, albeit at a slower pace than some expected, but it is changing. More and more projects are been given green light – without losing the focus on environmental issues, societal changes have been signaled without ruffling the opposition’s feathers and efforts are been made to drastically cut down the red tape and make India one of the world’s favored business destination (WB ranks us at 134 out of 189 economies ranked).

Modi also send the last reminiscent of India’s attempt of mimicking Soviet’s command economy – Planning Commission packing. With Planning Commission gone, the focus turns back to decentralization of Indian economy with states getting even more financing powers and autonomy going forward.

Sensex ended this week up by 1.2% while Nifty was up by 1.6% and Midcap up by 3.6%

Monday - Sensex up by 1.1%, Nifty up by 1.1%, Midcap up by 1.7%

Investors cheered as PM Narendra Modi delivered his maiden Independence Day speech where he vowed to make radical changes in the way country is run especially the bureaucratic setup. The news of declining WPI to five- month low and easing of tensions over Ukraine also boosted the positive sentiment.

Tuesday - Sensex up by 0.1%, Nifty up by 0.3%, Midcap up by 1.0%

Both Sensex and Nifty continued their journey upwards as oil retailers surged after Brent hit its 14-month low. FII sentiment is buoyed by positive noises made by Modi govt. on reforms and strong trust on RBI governor Raghuram Rajan’s ability to tackle exchange rate crises and inflation. Falling crude prices have also added to the bullish sentiment as India’s import burden eased.

Wednesday - Sensex down by 0.4%, Nifty down by 0.3%, Midcap up by 0.3%

Benchmark indices corrected after rallying continuously for six days as investors booked profits ahead of scheduled US Fed meeting on Thursday.

Thursday - Sensex up by 0.2%, Nifty up by 0.2%, Midcap up by 0.4%

Both Sensex and Nifty edged higher as FIIs continued to pour money in Indian markets, especially in blue-chips reflecting continued optimism about corporate earnings and a recovery in the domestic economy. Slipping in crude oil prices as China reported slowdown in its huge factory sector also helped the sentiment.

Friday - Sensex up by 0.2%, Nifty up by 0.3%, Midcap up by 0.2%

Nifty closed at its all-time high of 7,913.20 points led by IT stocks - which rallied on the news of improving prospects of US economy, and banks rose as RBI looks into reviewing lending caps to align them with global standards set by Basel committee.

Saturday, August 16, 2014

Weekly Market Commentary - Aug 11, 2014 - Aug 15, 2014

A very good week for the markets. Sensex went up by more than 770 points in the span of four trading days. Nomura raised BSE Sensex target to 30,310 by August 2015 citing the cyclical pick-up in growth. UBS maintained its 12-month Nifty target of 8,000 putting a premium on growth potential of the Indian economy especially when it comes out of ruts.

Narendra Modi's decision to do away with Planning Commission has unshackled the Indian states economy from the clutches of last remaining Soviet style institution. I couldn't think of a better way to say Happy Independence Day.

Sensex ended this week up by 3.1% while Nifty was up by 2.9% and Midcap up by 1.6%

Monday - Sensex up by 0.8%, Nifty up by 0.8%, Midcap up by 0.9%

Sensex and Nifty snapped their losing streak and rose nearly 1% on good numbers from stocks such as Mahindra & Mahindra and cooling-off in tensions between Russia and Ukraine. Realty stocks gained after SEBI put its stamp on FM’s decision of setting up of REITs, a widely acclaimed move that will offer a new source of financing to India's cash-strapped property developers and new investment vehicle to the nation.

Tuesday - Sensex up by 1.4%, Nifty up by 1.3%, Midcap up by 0.7%

Investors cheered the Tata Motors results – the firm tripled its quarterly net profit on back of strong JLR sales. Analysts are also upbeat about the overall health of the economy and expect July CPI to rise marginally to 7.40% from 7.31% in June, as per a Reuters’ poll. Also, a poll of 27 economists expects factory output in June to rise by 5.4% y-o-y in comparison with the 4.7% growth in May.

Wednesday - Sensex up by 0.1%, Nifty up by 0.2%, Midcap down by 1.1%

Sensex and Nifty ended the day marginally higher as gains in IT stocks due to weak rupee were offset by decline in capital goods stocks as BHEL’s earnings disappointed the street. Gains were also capped as lenders fell after govt. released July CPI data at 7.96% vs. 7.46% in June.

Thursday - Sensex up by 0.7%, Nifty up by 0.7%, Midcap up by 1.0%

Benchmark indices went up as WPI inflation dropped to five-month low level due to moderation in fuel costs and investors prepare for maiden Independence Day speech of PM Narendra Modi. Investors are expecting some key reform related announcements on Friday.

Friday – Exchanges closed on account of Independence Day

Narendra Modi's decision to do away with Planning Commission has unshackled the Indian states economy from the clutches of last remaining Soviet style institution. I couldn't think of a better way to say Happy Independence Day.

Sensex ended this week up by 3.1% while Nifty was up by 2.9% and Midcap up by 1.6%

Monday - Sensex up by 0.8%, Nifty up by 0.8%, Midcap up by 0.9%

Sensex and Nifty snapped their losing streak and rose nearly 1% on good numbers from stocks such as Mahindra & Mahindra and cooling-off in tensions between Russia and Ukraine. Realty stocks gained after SEBI put its stamp on FM’s decision of setting up of REITs, a widely acclaimed move that will offer a new source of financing to India's cash-strapped property developers and new investment vehicle to the nation.

Tuesday - Sensex up by 1.4%, Nifty up by 1.3%, Midcap up by 0.7%

Investors cheered the Tata Motors results – the firm tripled its quarterly net profit on back of strong JLR sales. Analysts are also upbeat about the overall health of the economy and expect July CPI to rise marginally to 7.40% from 7.31% in June, as per a Reuters’ poll. Also, a poll of 27 economists expects factory output in June to rise by 5.4% y-o-y in comparison with the 4.7% growth in May.

Wednesday - Sensex up by 0.1%, Nifty up by 0.2%, Midcap down by 1.1%

Sensex and Nifty ended the day marginally higher as gains in IT stocks due to weak rupee were offset by decline in capital goods stocks as BHEL’s earnings disappointed the street. Gains were also capped as lenders fell after govt. released July CPI data at 7.96% vs. 7.46% in June.

Thursday - Sensex up by 0.7%, Nifty up by 0.7%, Midcap up by 1.0%

Benchmark indices went up as WPI inflation dropped to five-month low level due to moderation in fuel costs and investors prepare for maiden Independence Day speech of PM Narendra Modi. Investors are expecting some key reform related announcements on Friday.

Friday – Exchanges closed on account of Independence Day

Sunday, August 10, 2014

Weekly Market Commentary - Aug 4, 2014 - Aug 8, 2014

The week started off with good positive movement in anticipation of more relaxation in funds available to lenders from RBI. RBI didn’t disappoint on that one. While reducing the SLR and bond holdings percentage in HTM portfolio, governor made sure the funds availability for investment into productive assets increases considerably.

The governor did acknowledge that the fight with inflation is far from being over and there needs to be more cautiousness and patience on the street before he gets into the rate cutting mood.

The highlight of the week was Governor Raghuram Rajan warning that global markets are at the risk of a "crash". The culprit he identified was the loose monetary policy game developed economies are playing where they are trying to outdo each other in charging rock bottom interest rates.

Raghuram Rajan in an interview said, “unfortunately, a number of macro- economists have not fully learned the lessons of the great financial crisis. They still do not pay enough attention - en passant - to the financial sector. Financial sector crises are not as predictable. The risks build up until, wham, it hits you".

Sensex ended this week down by 0.6% while Nifty was down by 0.4% and Midcap down by 1.1%

Monday - Sensex up by 1.0%, Nifty up by 1.1%, Midcap up by 1.1%

Benchmark indices started the week with an upward move led by software services exporters such as Infosys which gained as rupee weakened ahead of RBI's policy review. Market is widely expecting RBI to keep interest rates on hold as inflation is still outside central bank’s comfort zone.

Tuesday - Sensex up by 0.7%, Nifty up by 0.8%, Midcap up by 0.7%

Both Sensex and Nifty inched higher as RBI loosen the grip on liquidity more while keeping the interest rates unchanged as expected. Central bank reduced the Statutory Liquidity Ratio by 50bps to 22% of deposits (SLR is the amount of liquid assets such as gold or govt. (approved) securities, that a bank must maintain as reserves other than the cash). This move will help banks to channel more funds into productive sectors of the economy.

Wednesday - Sensex down by 0.9%, Nifty down by 1.0%, Midcap down by 0.6%

Markets snapped as RBI policy review effects get absorbed in the market. Lenders such as SBI and ICICI fell on worries that RBI move of reducing SLR requirement and amount of bonds in held-to-maturity (HTM) portfolio will led to rise in yields and decline in value of their debt holdings. The existing benchmark 10-year bond yield surged 10bps to 8.83%, its biggest single-day rise in four months, on Tuesday and an additional 2bps on Wednesday.

Thursday - Sensex down by 0.3%, Nifty down by 0.3%, Midcap down by 0.5%

Markets continued to trade weaker as both Sensex and Nifty declined by 0.3% on profit booking. Geo-political concerns also weighed on the investors’ mind.

Friday - Sensex down by 1.0%, Nifty down by 1.1%, Midcap down by 1.7%

Investors continued to stay cautious as US President Barack Obama authorized targeted air strikes in Iraq. There was a sell-off in global markets on rising worries of another drawn-out conflict in the region.

The governor did acknowledge that the fight with inflation is far from being over and there needs to be more cautiousness and patience on the street before he gets into the rate cutting mood.

The highlight of the week was Governor Raghuram Rajan warning that global markets are at the risk of a "crash". The culprit he identified was the loose monetary policy game developed economies are playing where they are trying to outdo each other in charging rock bottom interest rates.

Raghuram Rajan in an interview said, “unfortunately, a number of macro- economists have not fully learned the lessons of the great financial crisis. They still do not pay enough attention - en passant - to the financial sector. Financial sector crises are not as predictable. The risks build up until, wham, it hits you".

Sensex ended this week down by 0.6% while Nifty was down by 0.4% and Midcap down by 1.1%

Monday - Sensex up by 1.0%, Nifty up by 1.1%, Midcap up by 1.1%

Benchmark indices started the week with an upward move led by software services exporters such as Infosys which gained as rupee weakened ahead of RBI's policy review. Market is widely expecting RBI to keep interest rates on hold as inflation is still outside central bank’s comfort zone.

Tuesday - Sensex up by 0.7%, Nifty up by 0.8%, Midcap up by 0.7%

Both Sensex and Nifty inched higher as RBI loosen the grip on liquidity more while keeping the interest rates unchanged as expected. Central bank reduced the Statutory Liquidity Ratio by 50bps to 22% of deposits (SLR is the amount of liquid assets such as gold or govt. (approved) securities, that a bank must maintain as reserves other than the cash). This move will help banks to channel more funds into productive sectors of the economy.

Wednesday - Sensex down by 0.9%, Nifty down by 1.0%, Midcap down by 0.6%

Markets snapped as RBI policy review effects get absorbed in the market. Lenders such as SBI and ICICI fell on worries that RBI move of reducing SLR requirement and amount of bonds in held-to-maturity (HTM) portfolio will led to rise in yields and decline in value of their debt holdings. The existing benchmark 10-year bond yield surged 10bps to 8.83%, its biggest single-day rise in four months, on Tuesday and an additional 2bps on Wednesday.

Thursday - Sensex down by 0.3%, Nifty down by 0.3%, Midcap down by 0.5%

Markets continued to trade weaker as both Sensex and Nifty declined by 0.3% on profit booking. Geo-political concerns also weighed on the investors’ mind.

Friday - Sensex down by 1.0%, Nifty down by 1.1%, Midcap down by 1.7%

Investors continued to stay cautious as US President Barack Obama authorized targeted air strikes in Iraq. There was a sell-off in global markets on rising worries of another drawn-out conflict in the region.

Saturday, July 26, 2014

Saturday, July 19, 2014

Paranormal Activity - How Para 102 is a hidden gem in Jaitley's budget

Majority of people missed a very important piece of announcement on the budget day. Even I did not think about it till I decided to read the full budget transcript this Friday evening – yeah, that’s how I spend my Friday nights.

I found a hidden gem in the orgy of information and announcement in the para 102 – just where the discussion about MSME sector starts. Here is the snapshot:

And now why this para is important. Before I start torturing my keyboard, here is a snapshot from India Market Strategy Report from Credit Suisse published in July 2013 – exactly a year ago.

The report cites and analyses National Statistics Commission data and reckon that Half of India’s GDP and a whopping 90% of its employment is generated in informal sector. The report also mentions that “Unlike in the developed economies where informality is purely a deliberate choice to avoid taxation or regulations, in India it is more structural: a reflection of the lack of development and limited government reach.”

This does not mean that GDP of India is underestimated by 50%. Nah. GDP of any country is anyway an estimated number – but this estimate is particularly doubtful and is bound to get revised, hopefully upwards, if 50% is outside the reach of government surveyors. Government conducts surveys, updates its methodologies and its GDP calculation series every few years. Last time it was done GDP calculation jumped by 0.6% annualized for all years in the series. See the chart below.

This data has implications for taxpayers also. It is a well-known fact that India is one of the most taxed countries in the world. And it is by definition, informal sector is outside the purview of tax authorities. So the formal part of the economy gets taxed heavily.

What Arun Jaitley has tried to do in his maiden budget is sort of recognize the contribution made by the informal sector – Own account enterprises and decided to set up a committee to study ways to reach, cover, finance and then maybe tax them.

When countries around the globe are busy finding ways to generate income from erstwhile illegal activities – for example, sale of marijuana in some US states (read here, here and here), India already has all the money on the table but not in the record books.

If India is able to make some significant progress in this area, not only India will have higher reported GDP, better employment records but also better insurance and banking penetrations, more people under social security net and in the meanwhile tax net will increase and will bring more equity to the taxpayers around the country.

Wonder, where is the debate over this?

I found a hidden gem in the orgy of information and announcement in the para 102 – just where the discussion about MSME sector starts. Here is the snapshot:

And now why this para is important. Before I start torturing my keyboard, here is a snapshot from India Market Strategy Report from Credit Suisse published in July 2013 – exactly a year ago.

The report cites and analyses National Statistics Commission data and reckon that Half of India’s GDP and a whopping 90% of its employment is generated in informal sector. The report also mentions that “Unlike in the developed economies where informality is purely a deliberate choice to avoid taxation or regulations, in India it is more structural: a reflection of the lack of development and limited government reach.”

This does not mean that GDP of India is underestimated by 50%. Nah. GDP of any country is anyway an estimated number – but this estimate is particularly doubtful and is bound to get revised, hopefully upwards, if 50% is outside the reach of government surveyors. Government conducts surveys, updates its methodologies and its GDP calculation series every few years. Last time it was done GDP calculation jumped by 0.6% annualized for all years in the series. See the chart below.

This data has implications for taxpayers also. It is a well-known fact that India is one of the most taxed countries in the world. And it is by definition, informal sector is outside the purview of tax authorities. So the formal part of the economy gets taxed heavily.

What Arun Jaitley has tried to do in his maiden budget is sort of recognize the contribution made by the informal sector – Own account enterprises and decided to set up a committee to study ways to reach, cover, finance and then maybe tax them.

When countries around the globe are busy finding ways to generate income from erstwhile illegal activities – for example, sale of marijuana in some US states (read here, here and here), India already has all the money on the table but not in the record books.

If India is able to make some significant progress in this area, not only India will have higher reported GDP, better employment records but also better insurance and banking penetrations, more people under social security net and in the meanwhile tax net will increase and will bring more equity to the taxpayers around the country.

Wonder, where is the debate over this?

Sunday, July 13, 2014

Weekly Market Commentary - July 07, 2014 - July 11, 2014

The most anticipated week since the general elections have concluded this Friday with Sensex experiencing a wild swing of more than 1200 points. Markets easily reached the all-time high status on Monday rising on hopes of “game-changing” budget, and ended the week in red after sky high hopes met the ground. To be fair, investors were expecting too much too soon. I will argue that FM did a good job of trying to prepare a solid fiscal ground for future growth. I bet that lot of subsidies would have got the axe if not for the fear of high inflation and weak monsoons. I will still give FM a modest 7/10. You can read my budget analysis here.

Sensex ended this week down by 3.6% while Nifty was down by 3.8% and Midcap down by 8.1%

Monday - Sensex up by 0.5%, Nifty up by 0.5%, Midcap up by 0.2%

Markets continued to roll on the expectations of better earnings expectations from Infosys and hopes of a fiscally prudent budget from Narendra Modi govt. FIIs have bought more than $10.5bn worth of equities so far this year.

Tuesday - Sensex down by 2.0%, Nifty down by 2.1%, Midcap down by 4.3%

Investors’ hopes were dashed as railway budget presented by govt. was devoid of any radical plan to turnaround railways. The budget also lacked specifics about much touted PPP route to raise funding for projects and was short of fresh ideas.

Wednesday - Sensex down by 0.5%, Nifty down by 0.5%, Midcap down by 1.6%

Markets continue to fall after railway budget turned out to be a bummer. Economy survey also highlighted the need for tough measures to shore up public finances and reduce inflation, raising expectations of a prudent and a non-populist budget.

Thursday - Sensex down by 0.3%, Nifty down by 0.2%, Midcap up by 0.6%

Budget day saw wild swings in the Sensex and Nifty levels. Investors were struggling to get a handle over the slew of measures announced by newly appointed FM. While the budget speech nailed the fiscal consolidation part, it lacked any growth stimulating measures, which spooked the markets, which ended the eventful day in red.

Friday - Sensex down by 1.4%, Nifty down by 1.4%, Midcap down by 3.2%

Markets continued to fall as investors booked profits amidst the disappointment over what few analysts call a “mile wide and inch deep” budget. With budget now out of the way, investors have trained their guns on global markets, earnings season and monsoon.

Sensex ended this week down by 3.6% while Nifty was down by 3.8% and Midcap down by 8.1%

Monday - Sensex up by 0.5%, Nifty up by 0.5%, Midcap up by 0.2%

Markets continued to roll on the expectations of better earnings expectations from Infosys and hopes of a fiscally prudent budget from Narendra Modi govt. FIIs have bought more than $10.5bn worth of equities so far this year.

Tuesday - Sensex down by 2.0%, Nifty down by 2.1%, Midcap down by 4.3%

Investors’ hopes were dashed as railway budget presented by govt. was devoid of any radical plan to turnaround railways. The budget also lacked specifics about much touted PPP route to raise funding for projects and was short of fresh ideas.

Wednesday - Sensex down by 0.5%, Nifty down by 0.5%, Midcap down by 1.6%

Markets continue to fall after railway budget turned out to be a bummer. Economy survey also highlighted the need for tough measures to shore up public finances and reduce inflation, raising expectations of a prudent and a non-populist budget.

Thursday - Sensex down by 0.3%, Nifty down by 0.2%, Midcap up by 0.6%

Budget day saw wild swings in the Sensex and Nifty levels. Investors were struggling to get a handle over the slew of measures announced by newly appointed FM. While the budget speech nailed the fiscal consolidation part, it lacked any growth stimulating measures, which spooked the markets, which ended the eventful day in red.

Friday - Sensex down by 1.4%, Nifty down by 1.4%, Midcap down by 3.2%

Markets continued to fall as investors booked profits amidst the disappointment over what few analysts call a “mile wide and inch deep” budget. With budget now out of the way, investors have trained their guns on global markets, earnings season and monsoon.

Friday, July 11, 2014

Budget 2014 - Economy before Markets

Arun Jaitley presented his maiden budget on Thursday. The expectations from the budget were running high since the Modi govt got elected to power with clear majority. Narendra Modi's election campaign was rife with promises of reforms, employment and better days ahead. This budget, along with the railway budget presented on Tuesday were closely watched as they signaled the real intentions of new govt in power. It was not just investor's but the general public's way of finding out whether Modi govt can walk the talk.

Arun Jaitley, in a limited time and little maneuvering room available to him did a good job. He presented a budget which clearly indicated that India meant business. He, through his policy announcements tried to build a strong foundation for pro-growth path ahead. He did not fell in the trap of announcing reform measures to make stock market investors happy. Rather, he kept the focus on the audacious task of bringing economy house in order now, so that the benefits of growth can be reaped by all later.

But this budget was also not without few misses and disappointments. Many investors expected some announcement of doing away with controversial tax laws which FM has deliberately chose not to address. He explained his reasoning here in this interview. He also did not mention any policy to strengthen the recovery mechanism for banks.

Most investors were keen to find out how FM will create a balance between fiscal consolidation and kickstart the growth cycle. FM bravely accepted the challenge of capping the fiscal deficit target at ambitious 4.1% set by his predecessor. The fact that markets would not have blamed him or his govt on seeing a higher target number clearly sets out the intentions of the new govt. How much success will he meet only time will tell. For now, we can see and check the math behind the numbers and see for ourselves how much of these targets are achievable.

To meet the fiscal deficits target, FM seems to rely heavily on aggressive tax collections targets and divestment proceeds. The tax revenue is assumed to grow by 19.8% over actual FY14 figures with nominal GDP growth estimate of 13.4%. This tax revenue target is difficult to achieve, if not entirely impossible. The implicit assumption of tax elasticity of 1.5 in the tax revenue target is more reasonable during boom times, not when economy is trying to get out of pits.

Also, a third of tax revenues is corporate taxes which depend on their profitability, something which is beyond govt control. It will be unfortunate if govt resort to tax terrorism like its predecessor. In the event of not meeting their targets, they may have to hike their divestment targets.

Speaking of divestment targets, govt is hoping to net Rs. 63,425 crores in proceeds. Private companies have raised Rs. 12,000 crores via QIPs (which were heavily oversubscribed) in last few months. With India receiving $20bn annual FII inflows, the divestment target does not look unreasonable. Most analysts/economists expects govt to put its stake in Coal India and ONGC on block for retail investors soon. This will not only help achieve divestment targets, they will also help govt to adhere to SEBI prescribed promotor stake limit.

All in all, I think govt is on right track prioritizing fiscal consolidation over pro-growth measures. It would have been easy for govt to get carried away as country struggles with low growth rates, high inflation and threats of weak monsoons and drought situations. Instead, FM focused on getting the house in order, tightening the belts while trying not to hurt the wallet of general public and preparing the ground for better days ahead.

Arun Jaitley, in a limited time and little maneuvering room available to him did a good job. He presented a budget which clearly indicated that India meant business. He, through his policy announcements tried to build a strong foundation for pro-growth path ahead. He did not fell in the trap of announcing reform measures to make stock market investors happy. Rather, he kept the focus on the audacious task of bringing economy house in order now, so that the benefits of growth can be reaped by all later.

But this budget was also not without few misses and disappointments. Many investors expected some announcement of doing away with controversial tax laws which FM has deliberately chose not to address. He explained his reasoning here in this interview. He also did not mention any policy to strengthen the recovery mechanism for banks.

Most investors were keen to find out how FM will create a balance between fiscal consolidation and kickstart the growth cycle. FM bravely accepted the challenge of capping the fiscal deficit target at ambitious 4.1% set by his predecessor. The fact that markets would not have blamed him or his govt on seeing a higher target number clearly sets out the intentions of the new govt. How much success will he meet only time will tell. For now, we can see and check the math behind the numbers and see for ourselves how much of these targets are achievable.

To meet the fiscal deficits target, FM seems to rely heavily on aggressive tax collections targets and divestment proceeds. The tax revenue is assumed to grow by 19.8% over actual FY14 figures with nominal GDP growth estimate of 13.4%. This tax revenue target is difficult to achieve, if not entirely impossible. The implicit assumption of tax elasticity of 1.5 in the tax revenue target is more reasonable during boom times, not when economy is trying to get out of pits.

Also, a third of tax revenues is corporate taxes which depend on their profitability, something which is beyond govt control. It will be unfortunate if govt resort to tax terrorism like its predecessor. In the event of not meeting their targets, they may have to hike their divestment targets.

Speaking of divestment targets, govt is hoping to net Rs. 63,425 crores in proceeds. Private companies have raised Rs. 12,000 crores via QIPs (which were heavily oversubscribed) in last few months. With India receiving $20bn annual FII inflows, the divestment target does not look unreasonable. Most analysts/economists expects govt to put its stake in Coal India and ONGC on block for retail investors soon. This will not only help achieve divestment targets, they will also help govt to adhere to SEBI prescribed promotor stake limit.

All in all, I think govt is on right track prioritizing fiscal consolidation over pro-growth measures. It would have been easy for govt to get carried away as country struggles with low growth rates, high inflation and threats of weak monsoons and drought situations. Instead, FM focused on getting the house in order, tightening the belts while trying not to hurt the wallet of general public and preparing the ground for better days ahead.

Friday, June 27, 2014

World Wide Web

Excellent infographic by Euromonitor on worldwide web of trades.

Hat tip: The Big Picture

Click on the image to enlarge

Hat tip: The Big Picture

Click on the image to enlarge

Thursday, June 26, 2014

El Niño - Spoiler Alert!

It goes without saying that Indian growth story is strongly dependent on rainfall. Any shortfall, and we all scramble for places to hide from resulting high prices of agri commodities.

To make matters worse, a recent forecast that El Niño weather phenomenon, has a 90% chance of striking this year, can cause trouble for India. Rise in prices due to drought conditions (deficient water supply, lower crop output) in many areas led to riots in several countries in 2007.

As you can see in the graphic below, that India will suffer a dry spell with weaker monsoon rains but US will get a relief from drought in the west.

Click image to enlarge

The latest prediction is from European Centre for Medium-range Weather Forecasts, which is one of the most reliable of prediction centres around the world.

They have clarified that the amount of warm water in the Pacific is perhaps the biggest since the 1997-98 event which led to hottest year on record at that time.

The picture will become clearer in a month or two whether this year’s El Niño will be a small or a major event.

To make matters worse, a recent forecast that El Niño weather phenomenon, has a 90% chance of striking this year, can cause trouble for India. Rise in prices due to drought conditions (deficient water supply, lower crop output) in many areas led to riots in several countries in 2007.

As you can see in the graphic below, that India will suffer a dry spell with weaker monsoon rains but US will get a relief from drought in the west.

Click image to enlarge

The latest prediction is from European Centre for Medium-range Weather Forecasts, which is one of the most reliable of prediction centres around the world.

They have clarified that the amount of warm water in the Pacific is perhaps the biggest since the 1997-98 event which led to hottest year on record at that time.

The picture will become clearer in a month or two whether this year’s El Niño will be a small or a major event.

Subscribe to:

Posts (Atom)