Engineers India Ltd’s follow-on-public offer has finally hit the market yesterday. Govt. is looking forward to raise around INR 500 Crores through divesting its 10% stake in the PSU mini-ratna company, where it currently holds 80.4% of total share. EIL is offering its share in a price band of INR 145 – 150 until Feb 10, 2014 (Monday). EIL is also offering a discount of INR 6 to retail investors (ones who will be bidding for less than INR 2 lakhs) and its employees.

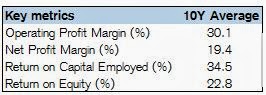

Engineers India is a leading EPC (Engineering, Procurement and Construction) and Consultancy organization of India. It undertakes major complex engineering projects like construction, expansion and maintenance of oil refineries, port terminals, chemical and fertilizer plants etc. It has grown its net profit at a CAGR of 25% in last 9 years (until Mar 2013). With a ten-year average return on capital employed of solid 34.5%, the firm has solid capital allocation and project execution track record.

Now, if investors look at the balance sheet of the firm, they will realize the true genius of its management. The firm has net operating assets of only INR 404 crores on which it has generated operating profits in tune of INR 815 crores in FY13 The firm has net worth of INR 2,295 crores while the total treasury of the business is at INR 2,436 crores. If you include current investments in the calculations made in the table below, the net operating assets stands at negative figure.

Essentially, company has more treasury than shareholders’ funds. This is because in current uncertain economic environment, policy paralysis, no new investments are happening on the ground. That does not mean in any way reflect on the superior capital allocation capabilities of the company's management. So, company is sitting with tons of cash just waiting to deploy it to earn solid ~35% returns.

Conclusion

Not every good business is necessarily a good investment at a given price. Even some of the strong business models have generated negative returns for its investors if they bought it when the stock was overvalued.

The simplest of the way to find out whether the stock is under or overvalued is to ask a simple question: How much future growth in free cash flows current market price is factoring in?

My reverse DCF model suggests the implied FCF growth rate for next 10 years is -11% with a hefty discount rate of 15% and terminal growth rate of 3%. Little hard to believe for the company which has grown its profits at 25% in last 10 years.

You can of course arrive at your own valuation by changing the assumptions of discount rate and terminal growth rates.

Backed with all these calculations, it appears that EIL is a good buy and retail investors should make a bid in its FPO.

Disclaimer: Invest at your own risk, you can lose money on a misprint :)

• Ujjivan Financial Services: The company commence operations as a small finance bank from February 1, 2017 completing business transfer of its business to Ujjivan Small Finance Bank.

ReplyDelete• Cosmo Films: The company commences new Biaxially Oriented Polypropylene Film (BOPP) line at Karjan in Gujarat.

• Tata Power: The company has completed acqusition of NELCO's defence business of unattended ground sensors (UGS).

CapitalStars