What does the company do?

Atul Auto is Gujarat's no.1 Three-Wheeler (3W) manufacturer. It has, in past few years, spread its wings across the country with 200 primary dealerships and 120 sub dealerships across 20 states in India. It manufactures and sell 3W in both Goods and Passengers segment in domestic market as well as other developing countries in Africa, Latin America and SE Asia.

How does it earn money?

Atul sells 3W under the brands of Atul Gem, Atul Shakti, Atul Elite etc. It derives more than 90% of its revenue from domestic market. Passenger sub-segment forms large share of its global sales (56%), followed by Cargo segment (40%) and spares and e-rickshaw forms the rest.

Atul Auto has a manufacturing plant located in Rajkot with an installed capacity of 60,000 units where it achieved capacity utilization of 83.59% in 2019. With company running its plants at peak capacity, the growth in sales will require expansion in its manufacturing capacity. For this, they have acquired land near Ahmedabad and are almost 90% finished with building a plant with another 60,000 units capacity (in two phases of 30,000 each).

Although the company has funded the expansion from its internal accruals, the plant delivery has been really slow with management acquiring the land in 2014 and promised to complete it by 2017 end. We are almost half way through 2020 and the plant is not ready yet for commercial production.

With ongoing pandemic situation, existing plant utilization has fallen off the cliff to less than 30%, it is expected that management will wait wait for demand to recover a bit before getting the second plant fully operational.

Three Wheeler Industry

India is the largest manufacturer, consumer and exporter of 3W in the world. In FY2019, we produced and sold more than 1M 3Ws. The industry has been growing at a pace of 9-10% every year.

3W fulfills a critical last mile connectivity function in the transportation market. Many Indians use 3W for intra-city travel and transport of goods. The countries with developing infrastructure and not so good road conditions are potential export target markets.

In 2020, pandemic has led to shut down of many plants and borders completely or partially for several months. The numbers for this year will naturally come down. It is expected that industry condition will get normal by the end of the year.

As many fleet owners who have financed their purchase either through banks or NBFCs, and have incurred almost zero revenue due to Covid induced lockdown, some stress is expected in the system. It is also expected that by the second half of the year, mobility options for many people in urban areas is bound to shift from large public transport systems like (local trains, buses) to taxis and autos. This may led to some demand recovery for 3W as the vehicle for choice for most cost sensitive customers.

However, in rural or tier 2/3 cities, where 3W carry load of many passengers, there remains few concerns. As panic conditions around the pandemic subsides, it is expected that the rural market will also return to normalcy by the end of year.

Also, any govt stimulus, either in terms of lowering of interest rates which will reduce the cost of financing of 3W or any govt stimulus to boost capital goods/infra demand in the economy bodes positive for the sector.

Competition

Bajaj auto is a clear market leader in 3W segment with 57% market share. Other major players in the market are Piaggio (~24% market share), TVS (~2%), M&M (~9%).

Market is clearly very competitive and Atul Auto is facing challenges in retaining whatever little market share from leaders like Bajaj Auto who have improved their grab from 47% in FY16 to 57% in FY20 where Atul has lost from 8% to 6%.

Main reason for this market share loss has been Bajaj Auto's aggressive focus on 3W Goods segment where it was little apprehensive earlier and avoided entering. Bajaj Auto has improved its market share from 1% in FY16 to 27% in FY20 and took away share from Piaggio (from 53% to 42%) which is market leader in Goods segment and Atul Auto whose market share went down from 21% to 16% in five years.

Past Performance

Atul Auto has done really well in the past with 10 yr (2009-2019) average growth rate being more than 20%. The firm has grown its revenues in almost all years except the year of demonetization (FY17) where it recorded a decline of 10% and FY20 (-6%) where Covid-19 has negatively impacted revenues across all sectors.

With lockdown continuing in many major cities and Atul Auto's plant operating at less than 50% utilization, the revenues for FY21 are also expected to decline by atleast 40-50%. It remains to be seen, how the firm defends its market share once the market is fully open.

Before the Covid induced lockdown happened, the firm was operating at almost full capacity, and was able to sell almost all its produce. With the new plant up and running maybe in last quarter of FY21, it is expected that Atul Auto will be able to bounce back to its 2019 volume very quickly.

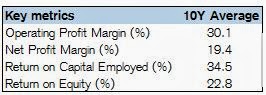

The firm has solid balance sheet and financial profile. The firm so far has managed to stay debt free and boasts of return on capital in excess of 30%. It also has enough liquidity to overcome any short term crisis. The Company has pre-approved bank credit facilities of Rs.15 crores from IDBI Bank Limited and $3.50mn from EXIM Bank in the form of cash credit, working capital demand loan and pre/ post shipment credit to meet the requirement of working capital in future.

Look Ahead

The firm also looks reasonable priced at an earning multiple of 6.5x and price to book of slightly more than 1.1x. The stock is depressed due to uncertainity related to Covid and auto industry move to convert their vehicles from BS-IV to BS-VI compliant in addition to the fact it operates in a very competitive market and faces challenge in gaining market share.

To overcome these challenges, Atul Auto is preparing to be future ready as it builds a strong product portfolio with e-auto and e-rickshaws, petrol 3W for export market and urban areas, grows its dealer network and availability of help to its domestic customers in financing their purchase through its NBFC associate Khushbu Finance Pvt Ltd.

The firm is also building a network of service attendants "Atul Sahay" for providing direct technical assistance in the servicing and maintenance of vehicles. The growth will be mentored by a prudent and debt averse management and the firm will definitely be able to strengthen its return profile.

Risks to look out for is delay in monthly sales recovery due to lockdown or restriction in goods and labour movement, restricted lending by financial institutions, adverse govt policy, challenges with export markets and any further than planned delays in operationalizing the second plant.

Conclusion

Atul Auto is a small horse in a very competitive 3W market race. It has been able to slowly strengthen its position outside its home market, Gujarat. Management seems to be conservative and prudent with their capital and ambitious enough to compete with likes of Bajaj Auto, Piaggio and M&M in both domestic and export market.

Atul Auto has a lot of headroom to grow but gaining market share will be a challenge. The firm has a solid balance sheet, returns and liquidity profile and looks set to regain its growth once the markets return to normalcy.

At the current valuation of 6.5x P/E and 1.1x of P/BV, the stock does look attractive and risk reward profile looks promising. It will be wise for an investor to continue monitor the monthly sales numbers to get the direction on recovery and also keep an eye on the developments in auto industry as it transitions towards greater safety and greener environment.