This inflation would not have been there, if there was no other source of liquidity available to this country. This change in price level has got nothing to do with the supply and demand of rice and coal but with the supply and demand of money. How much money is flowing in the market is actually the one and only determiner of inflation rate experienced by everyone. There might be few supply and demand shocks that may change the prices to drastic levels but that will be for short term as consumers will adjusts their portfolios to accommodate these changes. In the long run, it is the supply and demand of money which decided the inflation rate. As the central banker keeps on printing money, there will be more money available in the market which will lead to decline in the value of money which further will lead to every other good look expensive relative to the money.

Sunday, November 9, 2008

Inflation conundrum

This inflation would not have been there, if there was no other source of liquidity available to this country. This change in price level has got nothing to do with the supply and demand of rice and coal but with the supply and demand of money. How much money is flowing in the market is actually the one and only determiner of inflation rate experienced by everyone. There might be few supply and demand shocks that may change the prices to drastic levels but that will be for short term as consumers will adjusts their portfolios to accommodate these changes. In the long run, it is the supply and demand of money which decided the inflation rate. As the central banker keeps on printing money, there will be more money available in the market which will lead to decline in the value of money which further will lead to every other good look expensive relative to the money.

Saturday, October 18, 2008

Indices to watch out for!!

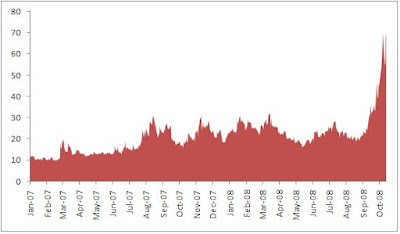

VIX has historically traded around 15-20 levels. But, in wake of recent financial turmoil, it has touched new highs of 80. More about VIX here and here.

The other graph indicates confidence in the commercial lending system of the economy. The indicator known as TED Spread is the difference between 3 month T-Bills interest rate and LIBOR. Increasing values indicate increase in counterparty risk which means banks are feeling uneasy about lending to each other which leads to increase in cost of borrowings.

TED has crossed the level of 4% after remaining in the range of 10-50 bps historically.

The above two graphs illustrates the problems faced by financial economy in general, but the last graph show a trend which speaks volumes about slowdown in real economy and aggravates the fear of recession. Baltic Dry Index as it is called indicated the level of trade done globally through the sea-route. Unlike stock market, it is free of any speculative biases. As Wikipedia puts it

“Most directly, the index measures the demand for shipping capacity versus the supply of dry bulk carriers. However, since the demand for shipping varies with the amount of cargo that is being traded in the market (supply and demand) and the supply of ships is much less elastic than the demand for them, the index indirectly measures global supply and demand for the commodities shipped aboard dry bulk carriers, such as cement, coal and grain.”

BDI is trading at 1500 levels after touching all time highs to 11,793 in may 2008. For more information on BDI, see here and here.

Sunday, October 12, 2008

Middle of Nowhere

maybe we'll see rise of new financial world order.

They say, "House always win". As we see curtain drawing on wall street circus, we will be closely following the events and preparing ourselves for what may be the next and even bigger "House", apparently a rigged one.

Monday, December 10, 2007

The Road Not Taken - Robert Frost

| TWO roads diverged in a yellow wood, | |

| And sorry I could not travel both | |

| And be one traveler, long I stood | |

| And looked down one as far as I could | |

| To where it bent in the undergrowth; |