Markets cheered the vote-on-account. Some investors appreciated the excise duty cuts meant to boost the auto, manufacturing and capital goods sectors, while others celebrated FM meeting his fiscal deficit target of 4.8%. In fact, he has done better and achieved fiscal deficit of 4.6%. Sensex ended the week 300 points up.

However, if we look closely to the vote-on-account statements, we will observe that a lot of accounting talent has been put to use to fudge the numbers to meet the above target. FM postponed the subsidies; recorded revenues in advance; coaxed public sector companies like Coal India and few PSU banks into paying special dividends - harming the interest of their minority shareholders; moved money from one public company to another as in the case of IOC, where ONGC and Oil India will buy stake from govt.

Govt accounting has made Enron look good. Incoming govt will have an uphill task in getting the fiscal house in order.

Sensex ended this week up 1.6%, Nifty was up by 1.8% while CNX Midcap was up by 2.1%.

Monday – Sensex up by 0.5%, Nifty up by 0.4%, Midcap up by 0.1%

Markets recovered their lost ground during the closing as some buying emerged as air around the interim budget cleared. Govt move to reduce excise duty from 12% to 8% for small cars, bikes; from 30% to 24% for SUVs and; from 24% to 20% for mid segment cars came as a huge relief to reeling auto sector. Govt also reduce the excise duty for capital goods and consumer durables by 200 bps to provide a fillip to ailing manufacturing sector. FM’s accounting jugglery to meet fiscal deficit target helped India to escape the danger of rating cut from premier rating agencies.

Tuesday - Sensex up by 0.8%, Nifty up by 0.9%, Midcap up by 0.9%

Markets went up as the optimism from govt move to avoid the populism and provide a boost to certain sectors in the form of excise duty cuts improved the investor confidence. Banking sector stocks led the rally as expectations of turnaround in economy led to rise in expectations of more lending.

Wednesday – Sensex up by 0.4%, Nifty up by 0.4%, Midcap up by 0.6%

Benchmark indices continued to be buoyed by positive sentiment generated by vote-on-account. The gains were mainly on the back of overnight gains in the US market and sustained capital inflows from foreign funds.

Thursday – Sensex down by 0.9%, Nifty down by 1.0%, Midcap down by 0.2%

Market had a pullback as China reported weak manufacturing data and US maintained its stand of tapering of quantitative easing.

Friday – Sensex up by 0.8%, Nifty up by 1.1%, Midcap up by 0.8%

Stocks went up as US factory activity accelerated at its fastest pace in four years in February leading to rise in firming up of all Asian markets.

Saturday, February 22, 2014

Thursday, February 20, 2014

Tuesday, February 18, 2014

Warning shot!

What if world is turned on its head and it became more female dominated society instead of present male dominated one?

What happens when gender roles get reversed in the society?

How men will be able to cope with the everyday harassment that women of today’s times have to face?

Will men be still able to trivialize the sexist treatment meted out to other half of human race?

Watch andenjoy!

Hat-tip to French actress and director Éléonore Pourriat

What happens when gender roles get reversed in the society?

How men will be able to cope with the everyday harassment that women of today’s times have to face?

Will men be still able to trivialize the sexist treatment meted out to other half of human race?

Watch and

Hat-tip to French actress and director Éléonore Pourriat

Sunday, February 16, 2014

Weekly Market Commentary - Feb 10, 2014 - Feb 14, 2014

Highlights of this week will be the growing contrast between US economy, which has shown some strong signs of recovery in their economy, and Indian story, whose biggest facilitator public sector banks have started crumbling under the weight of increasing NPAs. The chance of some bank going under or requiring state assistance or bail-out have become very strong since United Bank of India story went out. State Bank of India’s weak results is indicator of how deep the mess is.

It is India’s worst kept secret that our public sector banks (and their investors) are suffering under crony capitalism –which reached its zenith under UPA regime. It is a high time now when our banking regulator – RBI may take a leaf out of its Governor Raghuram Rajan’s widely read book “Saving Capitalism from the Capitalist”- rolls up its sleeve and gets our banks out of clutches of this govt-crony nexus.

Sensex ended this week flat, Nifty was slightly down by 0.2% while CNX Midcap was down by 1.3%.

Monday – Sensex down by 0.2%, Nifty down by 0.2%, Midcap down by 0.3%

Markets continued their lackadaisical performance as earnings season continues without any major surprise. Investors continued to book profits on IT and banking sectors. Beginning of two-day nationwide strike by public sector bank staff also affected the trading on banking counters.

Tuesday - Sensex up by 0.1%, Nifty up by 0.2%, Midcap up by 0.1%

Indices rose slightly led by two Tata group companies. Tata motors rose the most in two months after its quarterly profit tripled. Tata Steel Ltd gained to its highest level in three weeks before its earnings report. The gains in Sensex were offset by fall in RIL shares after Delhi Chief Minister Arvind Kejriwal filed an FIR against Mukesh Ambani.

Wednesday – Sensex up by 0.4%, Nifty up by 0.4%, Midcap flat

Markets rallied after US Congress agreed to advance legislation extending US borrowing authority. Also, newly appointed Fed Chairman Janet Yellen held off from making any changes to tapering schedule set the Asian shares soaring.

Thursday – Sensex down by 1.2%, Nifty down by 1.4%, Midcap down by 1.3%

Earnings disappointment in Cipla and Coal India stocks dragged the benchmark indices down. Also, govt released data indicated that industrial output contracted by 0.6% in December meaning all is still not well with the economy although retail inflation did ease to its two year low of 8.79%.

Friday – Sensex up by 0.9%, Nifty up by 0.8%, Midcap up by 0.3%

Sensex rose on last day of the week as some traders rushed to cover their shorts ahead of presentation of interim union budget next week. Meanwhile, January WPI numbers came at 5.05% vs. 6.2% in December, lower than ET-Now poll estimate of 5.5%.

It is India’s worst kept secret that our public sector banks (and their investors) are suffering under crony capitalism –which reached its zenith under UPA regime. It is a high time now when our banking regulator – RBI may take a leaf out of its Governor Raghuram Rajan’s widely read book “Saving Capitalism from the Capitalist”- rolls up its sleeve and gets our banks out of clutches of this govt-crony nexus.

Sensex ended this week flat, Nifty was slightly down by 0.2% while CNX Midcap was down by 1.3%.

Monday – Sensex down by 0.2%, Nifty down by 0.2%, Midcap down by 0.3%

Markets continued their lackadaisical performance as earnings season continues without any major surprise. Investors continued to book profits on IT and banking sectors. Beginning of two-day nationwide strike by public sector bank staff also affected the trading on banking counters.

Tuesday - Sensex up by 0.1%, Nifty up by 0.2%, Midcap up by 0.1%

Indices rose slightly led by two Tata group companies. Tata motors rose the most in two months after its quarterly profit tripled. Tata Steel Ltd gained to its highest level in three weeks before its earnings report. The gains in Sensex were offset by fall in RIL shares after Delhi Chief Minister Arvind Kejriwal filed an FIR against Mukesh Ambani.

Wednesday – Sensex up by 0.4%, Nifty up by 0.4%, Midcap flat

Markets rallied after US Congress agreed to advance legislation extending US borrowing authority. Also, newly appointed Fed Chairman Janet Yellen held off from making any changes to tapering schedule set the Asian shares soaring.

Thursday – Sensex down by 1.2%, Nifty down by 1.4%, Midcap down by 1.3%

Earnings disappointment in Cipla and Coal India stocks dragged the benchmark indices down. Also, govt released data indicated that industrial output contracted by 0.6% in December meaning all is still not well with the economy although retail inflation did ease to its two year low of 8.79%.

Friday – Sensex up by 0.9%, Nifty up by 0.8%, Midcap up by 0.3%

Sensex rose on last day of the week as some traders rushed to cover their shorts ahead of presentation of interim union budget next week. Meanwhile, January WPI numbers came at 5.05% vs. 6.2% in December, lower than ET-Now poll estimate of 5.5%.

Sunday, February 9, 2014

Weekly Market Commentary - Feb 3, 2014 - Feb 7, 2014

Indian investors seem to have become defensive, as no new strong catalysts seem to emerge before elections in May. In fact, some of them are worried that current establishment may play a populist card to garner as much voting support as it can. The 70,000 crores farm loan waiver that UPA govt doled out is still bleeding the public sector banks’ balance sheets.

FIIs are already closing out positions in India and are avoiding fresh positions till elections. They have cut their positions worth $340mn since US Fed decided to cut its stimulus package further by $10bn on Jan 29.

Indian markets are expected to be “source of fund” for FIIs in coming months as they put their money in other markets where current environment is more congenial.

Sensex and Nifty ended this week with losses of 0.7% and 0.4% respectively while CNX Midcap fell 0.8%.

Monday – Sensex down by 1.5%, Nifty down by 1.4%, Midcap down by 1.1%

Markets continued their weak performance from previous week with Sensex falling more than 300 points as China manufacturing slowdown coupled with US Fed’s cut in stimulus spending sent caution among the foreign investors across the globe.

Tuesday - Sensex and Nifty flat, Midcap up by 0.4%

Indices recovered a little as investors cover their shorts and some value emerged during the end of the day. FIIs continued to stay net sellers and are expected to avoid any fresh buying before elections.

Wednesday – Sensex up by 0.2%, Nifty up by 0.4%, Midcap up by 0.6%

Markets stayed beaten down with no fresh buying seen across most of the counters. Short covering led to the up movement in some of the indices stocks.

Thursday – Sensex up by 0.2%, Nifty up by 0.2%, Midcap up by 0.3%

Market inched towards its week high as FIIs turned net buyers. Bargain hunting is leading to small gains in the indices as Indian markets continues to practice caution like other emerging markets ahead of US non-farm payroll data.

Friday – Sensex up by 0.3%, Nifty up by 0.4%, Midcap up by 0.7%

Markets ended the day at its week high as all emerging markets took cue from small US rally previous day. US stocks rallied ahead of non-farm payrolls data as unemployment benefit applications declined which is as indications of improving labour market and US recovery.

FIIs are already closing out positions in India and are avoiding fresh positions till elections. They have cut their positions worth $340mn since US Fed decided to cut its stimulus package further by $10bn on Jan 29.

Indian markets are expected to be “source of fund” for FIIs in coming months as they put their money in other markets where current environment is more congenial.

Sensex and Nifty ended this week with losses of 0.7% and 0.4% respectively while CNX Midcap fell 0.8%.

Monday – Sensex down by 1.5%, Nifty down by 1.4%, Midcap down by 1.1%

Markets continued their weak performance from previous week with Sensex falling more than 300 points as China manufacturing slowdown coupled with US Fed’s cut in stimulus spending sent caution among the foreign investors across the globe.

Tuesday - Sensex and Nifty flat, Midcap up by 0.4%

Indices recovered a little as investors cover their shorts and some value emerged during the end of the day. FIIs continued to stay net sellers and are expected to avoid any fresh buying before elections.

Wednesday – Sensex up by 0.2%, Nifty up by 0.4%, Midcap up by 0.6%

Markets stayed beaten down with no fresh buying seen across most of the counters. Short covering led to the up movement in some of the indices stocks.

Thursday – Sensex up by 0.2%, Nifty up by 0.2%, Midcap up by 0.3%

Market inched towards its week high as FIIs turned net buyers. Bargain hunting is leading to small gains in the indices as Indian markets continues to practice caution like other emerging markets ahead of US non-farm payroll data.

Friday – Sensex up by 0.3%, Nifty up by 0.4%, Midcap up by 0.7%

Markets ended the day at its week high as all emerging markets took cue from small US rally previous day. US stocks rallied ahead of non-farm payrolls data as unemployment benefit applications declined which is as indications of improving labour market and US recovery.

Friday, February 7, 2014

Engineers India: Solid fundamentals; Buy for Long Term

Engineers India Ltd’s follow-on-public offer has finally hit the market yesterday. Govt. is looking forward to raise around INR 500 Crores through divesting its 10% stake in the PSU mini-ratna company, where it currently holds 80.4% of total share. EIL is offering its share in a price band of INR 145 – 150 until Feb 10, 2014 (Monday). EIL is also offering a discount of INR 6 to retail investors (ones who will be bidding for less than INR 2 lakhs) and its employees.

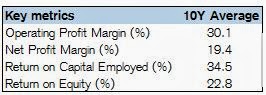

Engineers India is a leading EPC (Engineering, Procurement and Construction) and Consultancy organization of India. It undertakes major complex engineering projects like construction, expansion and maintenance of oil refineries, port terminals, chemical and fertilizer plants etc. It has grown its net profit at a CAGR of 25% in last 9 years (until Mar 2013). With a ten-year average return on capital employed of solid 34.5%, the firm has solid capital allocation and project execution track record.

Now, if investors look at the balance sheet of the firm, they will realize the true genius of its management. The firm has net operating assets of only INR 404 crores on which it has generated operating profits in tune of INR 815 crores in FY13 The firm has net worth of INR 2,295 crores while the total treasury of the business is at INR 2,436 crores. If you include current investments in the calculations made in the table below, the net operating assets stands at negative figure.

Essentially, company has more treasury than shareholders’ funds. This is because in current uncertain economic environment, policy paralysis, no new investments are happening on the ground. That does not mean in any way reflect on the superior capital allocation capabilities of the company's management. So, company is sitting with tons of cash just waiting to deploy it to earn solid ~35% returns.

Conclusion

Not every good business is necessarily a good investment at a given price. Even some of the strong business models have generated negative returns for its investors if they bought it when the stock was overvalued.

The simplest of the way to find out whether the stock is under or overvalued is to ask a simple question: How much future growth in free cash flows current market price is factoring in?

My reverse DCF model suggests the implied FCF growth rate for next 10 years is -11% with a hefty discount rate of 15% and terminal growth rate of 3%. Little hard to believe for the company which has grown its profits at 25% in last 10 years.

You can of course arrive at your own valuation by changing the assumptions of discount rate and terminal growth rates.

Backed with all these calculations, it appears that EIL is a good buy and retail investors should make a bid in its FPO.

Disclaimer: Invest at your own risk, you can lose money on a misprint :)

Engineers India is a leading EPC (Engineering, Procurement and Construction) and Consultancy organization of India. It undertakes major complex engineering projects like construction, expansion and maintenance of oil refineries, port terminals, chemical and fertilizer plants etc. It has grown its net profit at a CAGR of 25% in last 9 years (until Mar 2013). With a ten-year average return on capital employed of solid 34.5%, the firm has solid capital allocation and project execution track record.

Now, if investors look at the balance sheet of the firm, they will realize the true genius of its management. The firm has net operating assets of only INR 404 crores on which it has generated operating profits in tune of INR 815 crores in FY13 The firm has net worth of INR 2,295 crores while the total treasury of the business is at INR 2,436 crores. If you include current investments in the calculations made in the table below, the net operating assets stands at negative figure.

Essentially, company has more treasury than shareholders’ funds. This is because in current uncertain economic environment, policy paralysis, no new investments are happening on the ground. That does not mean in any way reflect on the superior capital allocation capabilities of the company's management. So, company is sitting with tons of cash just waiting to deploy it to earn solid ~35% returns.

Conclusion

Not every good business is necessarily a good investment at a given price. Even some of the strong business models have generated negative returns for its investors if they bought it when the stock was overvalued.

The simplest of the way to find out whether the stock is under or overvalued is to ask a simple question: How much future growth in free cash flows current market price is factoring in?

My reverse DCF model suggests the implied FCF growth rate for next 10 years is -11% with a hefty discount rate of 15% and terminal growth rate of 3%. Little hard to believe for the company which has grown its profits at 25% in last 10 years.

You can of course arrive at your own valuation by changing the assumptions of discount rate and terminal growth rates.

Backed with all these calculations, it appears that EIL is a good buy and retail investors should make a bid in its FPO.

Disclaimer: Invest at your own risk, you can lose money on a misprint :)

Sunday, February 2, 2014

Weekly Market Commentary - Jan 27, 2014 - Jan 31, 2014

RBI governor threw in a surprise again this week. He maintained the RBI’s stance of treating inflation as its enemy no.1 while increasing the repo rate to 8%. Street was expecting no change in interest rates, some even calling for a cut now with food inflation especially vegetable inflation coming down from recent highs. Last week Urijit Patel committee made a recommendation to RBI to replace WPI by CPI as inflation benchmark for calibrating further policy actions. It is too early to say whether RBI has indeed taken up these recommendations. If that is the case, we’ll see more rate hikes in near future to contain CPI inflation and get it under RBI’s comfort zone.

Sensex and Nifty ended this week with losses of 2.9% and 2.8% respectively while CNX Midcap fell 1.6%.

Monday – Sensex down by 2.0%, Nifty down by 2.1%, Midcap down by 2.9%

Markets tumbled as investors pull out money across emerging markets before Fed tapering announcement. Fed is expected to make another cut in stimulus in Ben Bernanke’s last meeting as Fed chairman. Also, weak PMI data from China last week coupled with Argentina abandoning support of its currency peso on the open market, which led to its 15% slide, affected the investor sentiment.

Tuesday - Sensex down by 0.1%, Nifty down by 0.2%, Midcap down by 0.1%

After an onslaught on previous day, market’s attempts to recover, on the back of short coverings, was cut short by RBI’s decision to hike the repo rate by 25bps to 8%. RBI governor Raghuram Rajan defended his actions by claiming that growth cannot be had unless we have inflation totally under control. He pointed out that although CPI inflation excluding food and fuel has remained flat, WPI inflation excluding food and fuel has risen prompting a rate hike from RBI.

Wednesday – Sensex down by 0.2%, Nifty down by 0.1%, Midcap up by 0.5%

Investors stayed on the sidelines as Fed ends its two-day meeting on Wednesday with most economists expecting a further stimulus cut as US recovery shows signs of traction. The stimulus has led to FIIs pouring $20bn in India in 2013. Though Indian govt and central bank maintains that they are prepared to meet any challenge thrown in by Fed tapering, it would be highly likely that any tapering announcement will negatively affect all emerging markets including India.

Thursday – Sensex down by 0.7%, Nifty down by 0.8%, Midcap down by 1.4%

And Fed did it again. Fed tapers another $10bn, signaling confidence that the US economy can stand on its own. This move had an expected negative impact on all emerging markets. Fed has indicated that it will keep on cutting its stimulus as recovery gains strength. Fed bond purchases now stands at $65bn a month.

Friday – Sensex up by 0.1%, Nifty up by 0.3%, Midcap up by 2.3%

Markets ended flat to slightly positive as investors recover from actions of Indian and US central banks. Indian markets closed January with a monthly loss of 3%, worst since Aug 2013.

Sensex and Nifty ended this week with losses of 2.9% and 2.8% respectively while CNX Midcap fell 1.6%.

Monday – Sensex down by 2.0%, Nifty down by 2.1%, Midcap down by 2.9%

Markets tumbled as investors pull out money across emerging markets before Fed tapering announcement. Fed is expected to make another cut in stimulus in Ben Bernanke’s last meeting as Fed chairman. Also, weak PMI data from China last week coupled with Argentina abandoning support of its currency peso on the open market, which led to its 15% slide, affected the investor sentiment.

Tuesday - Sensex down by 0.1%, Nifty down by 0.2%, Midcap down by 0.1%

After an onslaught on previous day, market’s attempts to recover, on the back of short coverings, was cut short by RBI’s decision to hike the repo rate by 25bps to 8%. RBI governor Raghuram Rajan defended his actions by claiming that growth cannot be had unless we have inflation totally under control. He pointed out that although CPI inflation excluding food and fuel has remained flat, WPI inflation excluding food and fuel has risen prompting a rate hike from RBI.

Wednesday – Sensex down by 0.2%, Nifty down by 0.1%, Midcap up by 0.5%

Investors stayed on the sidelines as Fed ends its two-day meeting on Wednesday with most economists expecting a further stimulus cut as US recovery shows signs of traction. The stimulus has led to FIIs pouring $20bn in India in 2013. Though Indian govt and central bank maintains that they are prepared to meet any challenge thrown in by Fed tapering, it would be highly likely that any tapering announcement will negatively affect all emerging markets including India.

Thursday – Sensex down by 0.7%, Nifty down by 0.8%, Midcap down by 1.4%

And Fed did it again. Fed tapers another $10bn, signaling confidence that the US economy can stand on its own. This move had an expected negative impact on all emerging markets. Fed has indicated that it will keep on cutting its stimulus as recovery gains strength. Fed bond purchases now stands at $65bn a month.

Friday – Sensex up by 0.1%, Nifty up by 0.3%, Midcap up by 2.3%

Markets ended flat to slightly positive as investors recover from actions of Indian and US central banks. Indian markets closed January with a monthly loss of 3%, worst since Aug 2013.

Subscribe to:

Comments (Atom)