The week started off with good positive movement in anticipation of more relaxation in funds available to lenders from RBI. RBI didn’t disappoint on that one. While reducing the SLR and bond holdings percentage in HTM portfolio, governor made sure the funds availability for investment into productive assets increases considerably.

The governor did acknowledge that the fight with inflation is far from being over and there needs to be more cautiousness and patience on the street before he gets into the rate cutting mood.

The highlight of the week was Governor Raghuram Rajan warning that global markets are at the risk of a "crash". The culprit he identified was the loose monetary policy game developed economies are playing where they are trying to outdo each other in charging rock bottom interest rates.

Raghuram Rajan in an interview said, “unfortunately, a number of macro- economists have not fully learned the lessons of the great financial crisis. They still do not pay enough attention - en passant - to the financial sector. Financial sector crises are not as predictable. The risks build up until, wham, it hits you".

Sensex ended this week down by 0.6% while Nifty was down by 0.4% and Midcap down by 1.1%

Monday - Sensex up by 1.0%, Nifty up by 1.1%, Midcap up by 1.1%

Benchmark indices started the week with an upward move led by software services exporters such as Infosys which gained as rupee weakened ahead of RBI's policy review. Market is widely expecting RBI to keep interest rates on hold as inflation is still outside central bank’s comfort zone.

Tuesday - Sensex up by 0.7%, Nifty up by 0.8%, Midcap up by 0.7%

Both Sensex and Nifty inched higher as RBI loosen the grip on liquidity more while keeping the interest rates unchanged as expected. Central bank reduced the Statutory Liquidity Ratio by 50bps to 22% of deposits (SLR is the amount of liquid assets such as gold or govt. (approved) securities, that a bank must maintain as reserves other than the cash). This move will help banks to channel more funds into productive sectors of the economy.

Wednesday - Sensex down by 0.9%, Nifty down by 1.0%, Midcap down by 0.6%

Markets snapped as RBI policy review effects get absorbed in the market. Lenders such as SBI and ICICI fell on worries that RBI move of reducing SLR requirement and amount of bonds in held-to-maturity (HTM) portfolio will led to rise in yields and decline in value of their debt holdings. The existing benchmark 10-year bond yield surged 10bps to 8.83%, its biggest single-day rise in four months, on Tuesday and an additional 2bps on Wednesday.

Thursday - Sensex down by 0.3%, Nifty down by 0.3%, Midcap down by 0.5%

Markets continued to trade weaker as both Sensex and Nifty declined by 0.3% on profit booking. Geo-political concerns also weighed on the investors’ mind.

Friday - Sensex down by 1.0%, Nifty down by 1.1%, Midcap down by 1.7%

Investors continued to stay cautious as US President Barack Obama authorized targeted air strikes in Iraq. There was a sell-off in global markets on rising worries of another drawn-out conflict in the region.

Sunday, August 10, 2014

Thursday, August 7, 2014

Sunday, August 3, 2014

Weekly Market Commentary - Jul 28, 2014 - Aug 1, 2014

Sensex ended this week down by 2.5% while Nifty was down by 2.4% and Midcap down by 0.2%

Monday - Sensex down by 0.5%, Nifty down by 0.5%, Midcap down by 0.3%

Investors continued to book profits in the blue chips names ahead of the derivative expiry this week. RBI monetary policy review on next Tuesday will be the next catalyst for Indian stocks.

Tuesday – Markets closed on Id-Ul-Fitr (Ramzan Id)

Wednesday - Sensex up by 0.4%, Nifty up by 0.6%, Midcap up by 0.7% Markets went up slightly after Bharti Airtel, Lupin Ltd and Dr Reddy's Laboratories Ltd posted results better than street expectations. The gains were capped ahead of derivative expiry, expected Fed statement later in the day and lower than consensus L&T results.

Thursday - Sensex down by 0.7%, Nifty down by 0.9%, Midcap up by 0.1% Markets fell on the derivative expiry day weighed down by FII sales after not so impressive numbers from Maruti Suzuki and HCL Technologies. Cadila Healthcare also slumped 4.5% USFDA made certain observations after conducting a "product specific" inspection of its Moraiya manufacturing plant.

Friday - Sensex down by 1.6%, Nifty down by 1.5%, Midcap down by 0.7%

Sensex and Nifty declined nearly by 1.5%, marking their biggest single-day fall in nearly 3-1/2 weeks in tandem with global market peers ahead of U.S. jobs data. Some analysts are anticipating that a strong US job report will prompt Fed towards interest rate hike, effectively slowing down the interest rates fueled rally across the globe.

Sunday, July 27, 2014

Weekly Market Commentary - July 21, 2014 - July 25, 2014

The earnings season is here. Investors have now moved on from the rhetoric generated from budget session and have now put their noses back to where they should belong – corporate earnings numbers. So far, the government has been playing to the FII gallery and moving fast on their reform agenda – tweaking laws, creating more enabling environment, removing confusions over controversial policies and implementing steps to allow more foreign capital.

In the near term, investors are going to focus on earnings numbers – L&T, Maruti Suzuki, Bharti Airtel and HLL are lined up for next week. RBI policy review on August 5 will also be keenly watched for any macroeconomic commentary and inflation/interest rate signals.

Sensex ended this week up by 1.9% while Nifty was up by 1.7% and Midcap down by 1.9%

Monday - Sensex up by 0.3%, Nifty up by 0.3%, Midcap down by 0.1%

Markets went up led by rally in Reliance Industries after it reported quarterly earnings better than street estimates. In near term, markets will remain driven by corporate earnings as no new trigger is in sight.

Tuesday - Sensex up by 1.2%, Nifty up by 1.1%, Midcap up by 0.1%

Sensex and Nifty surged more than 1% and traded near their all-time highs led by telecom stocks following Idea Cellular's better-than-expected earnings. Bharti Airtel and Idea Cellular both rallied more than 5% as sentiment around telecom stocks improved.

Wednesday - Sensex up by 0.5%, Nifty up by 0.4%, Midcap down by 0.4%

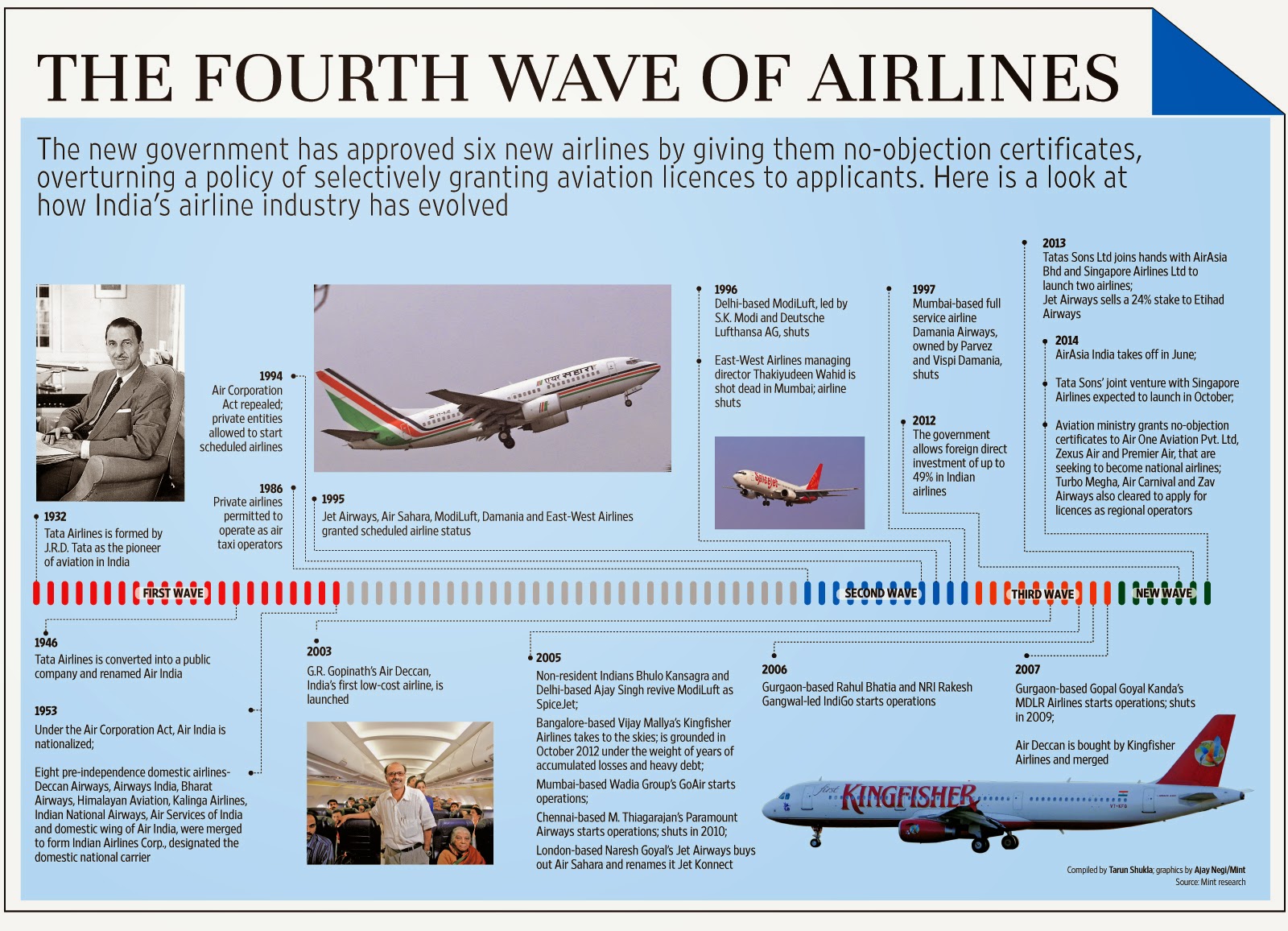

Benchmark Indices continued on their winning run bolstered by gains in IT and banking leaders on upbeat earnings, higher capital inflows and positive global cues. TCS attained a market valuation of over Rs. 5 lakh crores (or about $84bn) for the first time. Bank of Baroda gained around 3% after RBI removed the stock from its caution list, allowing FIIs to invest in it. Jet Airways also rose around 4% after its chairman discussed its restructuring plan involving selling planes and renegotiating debt.

Thursday - Sensex up by 0.5%, Nifty up by 0.4%, Midcap down by 0.2%

Sensex and Nifty rose to their record highs after decision to raise FDI limit in insurance got cabinet approval. Modi government is doing its best to revive foreign interest in India and raising the FDI limit from 26% to 49% in capital starved insurance sector highlights its reform agenda. Cairn India slumped by 7% as company disclosed a related party transaction worth $1.25bn in the form of loan facility to parent Vedanta Group. Analysts have always been wary of this move where the new promoter group might take advantage of cash pile of Cairn India to fund their other projects – a step widely considered detrimental to minority shareholders’ interest.

Friday - Sensex down by 0.6%, Nifty down by 0.5%, Midcap down by 1.3%

Markets took a breather on Friday after continuously rising for nine sessions. Tata Motors declined most in six months after JLR price cuts in China raised concerns on margins in a key market.

In the near term, investors are going to focus on earnings numbers – L&T, Maruti Suzuki, Bharti Airtel and HLL are lined up for next week. RBI policy review on August 5 will also be keenly watched for any macroeconomic commentary and inflation/interest rate signals.

Sensex ended this week up by 1.9% while Nifty was up by 1.7% and Midcap down by 1.9%

Monday - Sensex up by 0.3%, Nifty up by 0.3%, Midcap down by 0.1%

Markets went up led by rally in Reliance Industries after it reported quarterly earnings better than street estimates. In near term, markets will remain driven by corporate earnings as no new trigger is in sight.

Tuesday - Sensex up by 1.2%, Nifty up by 1.1%, Midcap up by 0.1%

Sensex and Nifty surged more than 1% and traded near their all-time highs led by telecom stocks following Idea Cellular's better-than-expected earnings. Bharti Airtel and Idea Cellular both rallied more than 5% as sentiment around telecom stocks improved.

Wednesday - Sensex up by 0.5%, Nifty up by 0.4%, Midcap down by 0.4%

Benchmark Indices continued on their winning run bolstered by gains in IT and banking leaders on upbeat earnings, higher capital inflows and positive global cues. TCS attained a market valuation of over Rs. 5 lakh crores (or about $84bn) for the first time. Bank of Baroda gained around 3% after RBI removed the stock from its caution list, allowing FIIs to invest in it. Jet Airways also rose around 4% after its chairman discussed its restructuring plan involving selling planes and renegotiating debt.

Thursday - Sensex up by 0.5%, Nifty up by 0.4%, Midcap down by 0.2%

Sensex and Nifty rose to their record highs after decision to raise FDI limit in insurance got cabinet approval. Modi government is doing its best to revive foreign interest in India and raising the FDI limit from 26% to 49% in capital starved insurance sector highlights its reform agenda. Cairn India slumped by 7% as company disclosed a related party transaction worth $1.25bn in the form of loan facility to parent Vedanta Group. Analysts have always been wary of this move where the new promoter group might take advantage of cash pile of Cairn India to fund their other projects – a step widely considered detrimental to minority shareholders’ interest.

Friday - Sensex down by 0.6%, Nifty down by 0.5%, Midcap down by 1.3%

Markets took a breather on Friday after continuously rising for nine sessions. Tata Motors declined most in six months after JLR price cuts in China raised concerns on margins in a key market.

Saturday, July 26, 2014

Subscribe to:

Posts (Atom)